When the Covid-19 pandemic erupted in early 2020, it disrupted nearly every part of daily life in the United States. Public health, the economy, and social interaction all shifted rapidly. Yet in the middle of that upheaval, one hobby captured renewed attention: baseball card collecting.

With people spending more time at home, many looked for familiar comforts, investments, or distractions. Baseball cards provided all three. The mix of nostalgia, speculative opportunity, and connection to America’s pastime created conditions for one of the hobby’s most dramatic booms in decades.

This article explores the story of the Covid-era baseball card market. It covers supply chain disruptions, product shortages, grading delays, industry growth, collector motivations, and the post-pandemic landscape. By focusing on baseball alone, it highlights how the sport’s deepest hobby was reshaped during a time of uncertainty and change.

A Sketch of the Covid Pandemic in the U.S.

In March 2020, the SARS-CoV-2 virus spread rapidly across the country. Stay-at-home orders, travel restrictions, and shutdowns of nonessential businesses followed. Sports were suspended or played without fans. Schools closed or moved online, and workplaces adopted remote systems on a massive scale.

Major League Baseball shortened its 2020 season, altered spring training, and operated under strict protocols. The absence of live games for months left fans searching for ways to stay connected. Baseball cards became one of the outlets that filled that gap.

This context of social distancing and disruption created the right environment for hobbies that could be done indoors, individually, or through online communities. Collecting baseball cards fit that model perfectly.

Disruptions to Supply Chains & Product Availability

The sudden surge in demand for baseball cards clashed with weakened supply chains. Collectors eager to buy and protect cards ran into repeated shortages.

Manufacturing facilities struggled with labor constraints and raw material delays. Paper, plastic, inks, and packaging materials were redirected to higher-priority uses, creating bottlenecks. Shipping delays and rising freight costs worsened the problem.

Distribution and retail channels also felt the strain. Warehouses faced staffing shortages, and delivery companies were overloaded with e-commerce packages. Hobby shops and retail outlets often operated under restricted hours or had to pause operations. Even when product was available, getting it into collectors’ hands was difficult.

Perhaps the most visible backlog emerged in grading. PSA, the leading grading company, faced a queue of over 12 million cards by mid-2021. Some collectors waited more than a year for returns. To cope, PSA suspended lower-tier submissions and raised prices, showing how fragile the system became under pressure.

Products & Formats Most Affected

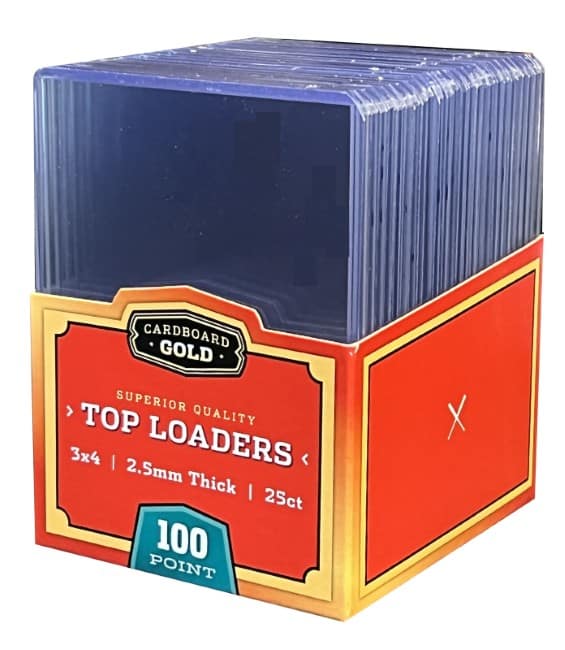

Not all items were equally affected by shortages. Protective supplies like toploaders, sleeves, and magnetic cases were hit hard. With many collectors sending cards for grading or storing higher-value items, demand for plastics soared while supply lagged. Sellers were forced to get creative with their packaging when they shipped or sold cards.

Premium cards such as autographs, parallels, and short-printed inserts also became more difficult to obtain. These required specialized printing and packaging, both of which were under stress. When they did reach the market, demand far outpaced supply, and prices rose quickly.

Even base sets were difficult to find. Retailers sold out of flagship releases, and big-box stores limited purchases per customer. Many collectors reported frustration trying to buy blasters or hobby boxes at retail price.

On the secondary market, raw cards gained importance. Graded cards commanded premiums due to their scarcity, but grading delays meant many buyers accepted raw versions as alternatives.

Industry Growth During Covid

The pandemic did not shrink the baseball card hobby. It expanded at a pace few could have predicted.

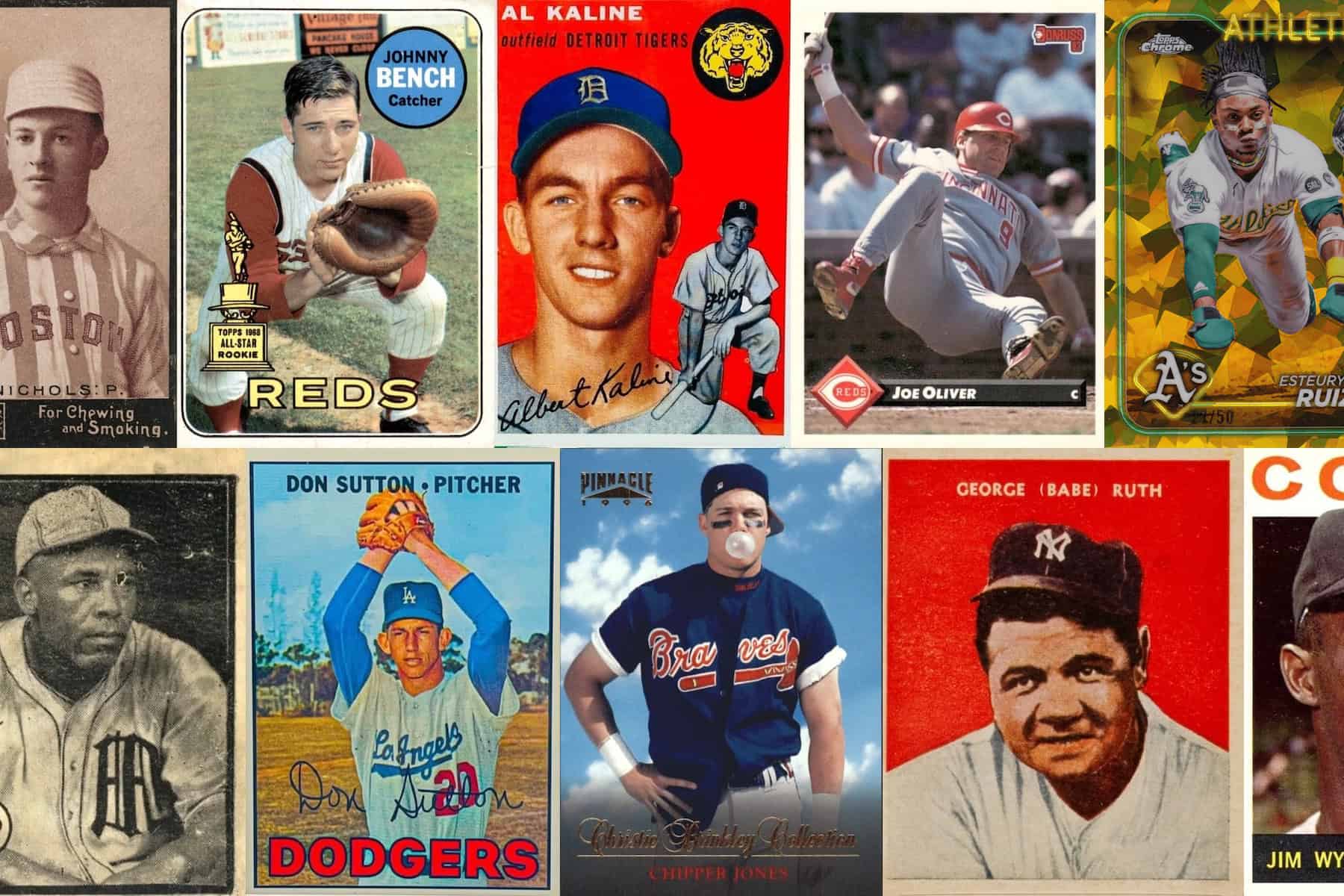

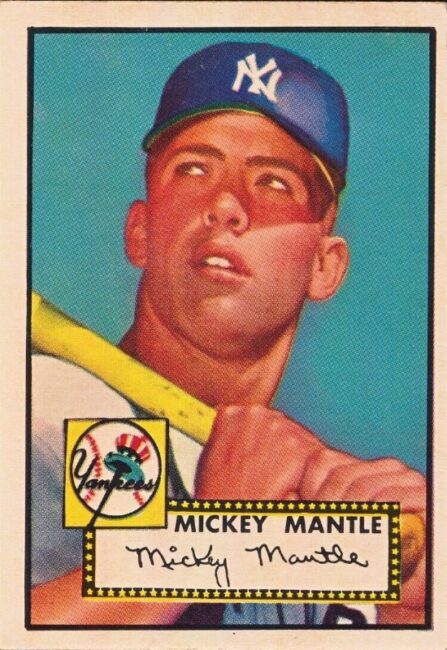

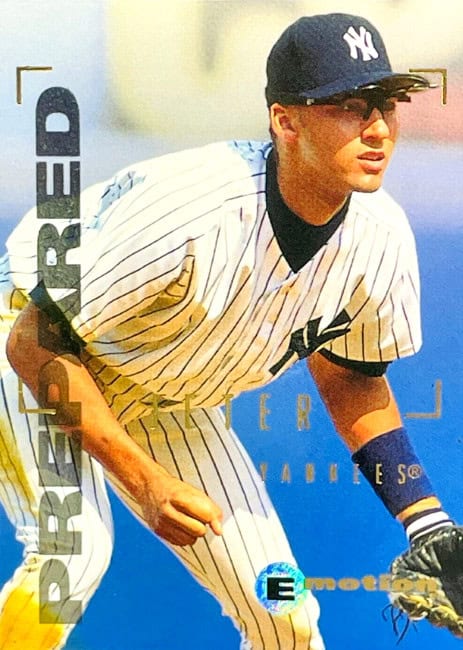

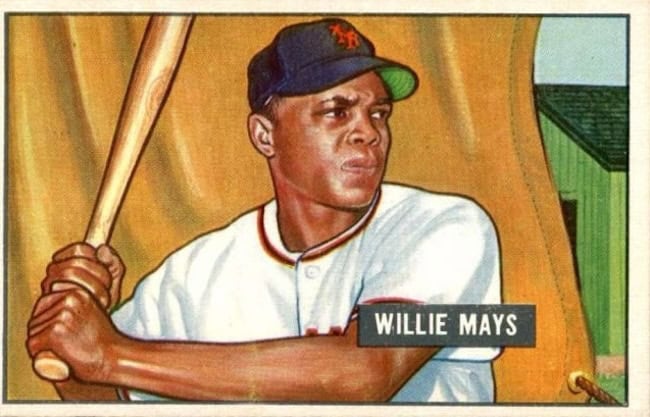

eBay reported that trading card sales in 2020 jumped 142 percent year-over-year. Baseball cards led in transaction volume, even if other sports captured more headlines. The frenzy pushed prices of top cards to new heights. A 1952 Topps Mickey Mantle in high grade eventually sold for $12.6 million in 2022, showing how the boom carried forward.

Collectors, dealers, and investors flooded into the market. Many were new entrants, some returning after decades, and others speculating for profit. Hobby shops experienced record sales, online breaks multiplied, and auction houses thrived.

At the same time, this growth was uneven. Some cards saw unsustainable spikes, while vintage and true rarities held steadier. The overall trend, however, was unmistakable: collecting experienced explosive growth during the Covid-era baseball card market.

Why Collectors Turned to Baseball Cards

The appeal of baseball card collecting during the pandemic came from several overlapping factors.

Nostalgia played a central role. Many collectors dusted off boxes from their youth and rediscovered the thrill of finding old favorites. In an uncertain time, the cards provided stability and memory.

The lack of live baseball games also pushed fans to seek another connection to their teams and players. Cards provided that link, serving as a substitute for ballpark experiences.

Economic conditions added fuel. Stimulus checks and reduced spending on travel or entertainment left households with more discretionary funds. Many funneled some of that into baseball cards.

Finally, the speculative side created a powerful draw. Flippers saw quick gains by grading and reselling hot rookies. Social media amplified success stories, drawing even more people into the chase.

The Post-Pandemic Collecting Landscape

By 2023 and 2024, the frenzy cooled, but the hobby did not collapse. Instead, it entered a phase of stabilization and refinement.

Prices for many cards corrected downward, especially speculative modern issues. Yet vintage and high-end rookies maintained or even gained value. The result was a stratified market where fundamentals mattered more.

Grading companies invested heavily in new infrastructure. PSA opened additional facilities and improved turnaround times. Costs rose, which discouraged submissions of low-value cards, but helped re-balance supply.

Data and analytics tools also matured. Collectors now use real-time pricing platforms and population reports to make informed decisions. The days of relying only on printed price guides are long gone.

Hobby shops and card shows have rebounded as gathering places. Many expanded during the boom and now focus on hybrid models that combine retail, breaks, and community events.

Meanwhile, card manufacturers introduced new innovations. Short runs, digital tie-ins, and parallel-heavy designs remain common. Collectors, however, are more discerning, focusing on long-term value and personal enjoyment rather than chasing every new release.

Additional Insights

For collectors who remained active during the Covid-era baseball card market surge, a handful of clear lessons emerged that continue to shape the hobby today.

First, vintage cards have proven remarkably stable. Because the supply is fixed and cannot be expanded, they were insulated from the kind of volatility that hit modern products during the wave of overproduction. Condition also took on even greater importance, with small flaws creating wide gaps in market value as buyers became more selective.

Another trend has been the rise of registry competition. Collectors chasing top-ranked graded sets intensified demand for high-grade examples, ensuring that set building remained vibrant even as prices fluctuated elsewhere. Meanwhile, hybrid digital-physical products have grown in visibility but still take a back seat to traditional cardboard in terms of collector interest and long-term value.

Finally, the extended grading backlogs of the period left a reservoir of cards that are still entering the marketplace, slowly reshaping supply levels and market dynamics. Together, these lessons serve as a snapshot of how the hobby adapted and what may continue to drive it forward in the years ahead.

Conclusion

The Covid pandemic reshaped baseball card collecting more than any other event in recent history. Supply chains faltered, grading collapsed under pressure, and product shortages frustrated collectors. Yet demand soared, fueled by nostalgia, economic conditions, and speculation.

The frenzy of 2020 and 2021 cooled into a more stable market. Baseball card collecting today remains larger, more organized, and more data-driven than it was before Covid. What began as a surge of interest during lockdown has left a lasting foundation for the hobby.

For baseball card collectors, the lesson of the Covid-era baseball card market is clear: the hobby can adapt, expand, and thrive even under the most unusual conditions.